How to Pay Yourself First Using the Profit First Method

As a service-based business owner, you work hard to generate revenue, but are you actually paying yourself first? Many entrepreneurs pay everyone else—vendors, software subscriptions, and other expenses—before even thinking about their own paycheck. The problem? If you wait until there’s “extra” money left, you may never truly pay yourself.

That’s where the Profit First method comes in. Instead of treating your pay as an afterthought, this system ensures you take care of yourself first while still keeping your business financially healthy.

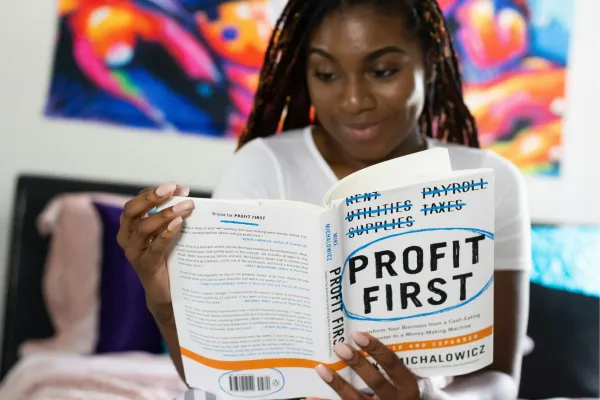

What Is the Profit First Method?

The Profit First system, created by Mike Michalowicz, flips traditional business finance on its head. Instead of the typical formula:

Revenue – Expenses = Profit

You use this approach:

Revenue – Profit = Expenses

This ensures you prioritize your pay and business profitability instead of letting expenses dictate what’s left.

Step 1: Set Up Separate Bank Accounts

To implement the Profit First method, open at least five business bank accounts:

1. Income Account – All business revenue is deposited here.

2. Profit Account – A percentage of income is set aside here before paying expenses.

3. Owner’s Pay Account – Your salary is transferred here regularly.

4. Taxes Account – Saves for quarterly and annual tax payments.

5. Operating Expenses Account – What’s left is used for running the business.

Step 2: Allocate Your Revenue

Every time money comes in, distribute it across your accounts based on pre-set percentages. A good starting point for a service-based business:

Profit: 5-10%

Owner’s Pay: 30-50%

Taxes: 15-30%

Operating Expenses: The remainder (what’s left after paying yourself)

Example Allocation

Let’s say your business brings in $10,000 this month and you’ve chosen these percentages:

✔ Profit (10%) → $1,000

✔ Owner’s Pay (40%) → $4,000

✔ Taxes (20%) → $2,000

✔ Operating Expenses (30%) → $3,000

Instead of wondering if you can afford to pay yourself, you’ve already taken care of it!

Step 3: Pay Yourself First—Consistently

Now that you’ve allocated funds, transfer your Owner’s Pay into your personal account on a set schedule (weekly, biweekly, or monthly). Treat it like a non-negotiable salary—just like if you were working for someone else.

Step 4: Run Your Business on What’s Left

Here’s where the magic happens: instead of trying to stretch your income to cover all your expenses, you limit your spending based on what’s available in the Operating Expenses account.

This forces you to:

✔ Cut unnecessary expenses

✔ Get creative about managing costs

✔ Keep more profit instead of overspending on your business

Step 5: Use Profit Wisely

The Profit Account is not for everyday spending. Each quarter, take half of what’s in this account as a reward for yourself—whether that’s savings, investments, or even something fun. The rest stays in the business as a financial cushion.

Why This Works for Service-Based Business Owners

Ensures you get paid first instead of last

Creates built-in profitability without waiting for "leftover" money

Prevents overspending and keeps expenses in check

Helps you plan for taxes instead of scrambling at tax time

Take Control of Your Business Finances

Your business should support your life—not the other way around. By using the Profit First system, you can consistently pay yourself, grow a profitable business, and reduce financial stress.

Need help setting up a system that works for you? Clever Bookkeeping Services, LLC can help to maintain accurate bookkeeping and financial reports which will allow you to implement Profit First and take control of your finances. Let’s chat!

Contact us today to learn how we can help your business thrive!